Smarte investeringer.

Helt simpelt.

Lysa helps you invest your money automatically in global ETF:s and index funds with ultra low fees.

Best in test:

Månedsopsparinger 2024

Investeringsrobotter 2021

Why Lysa

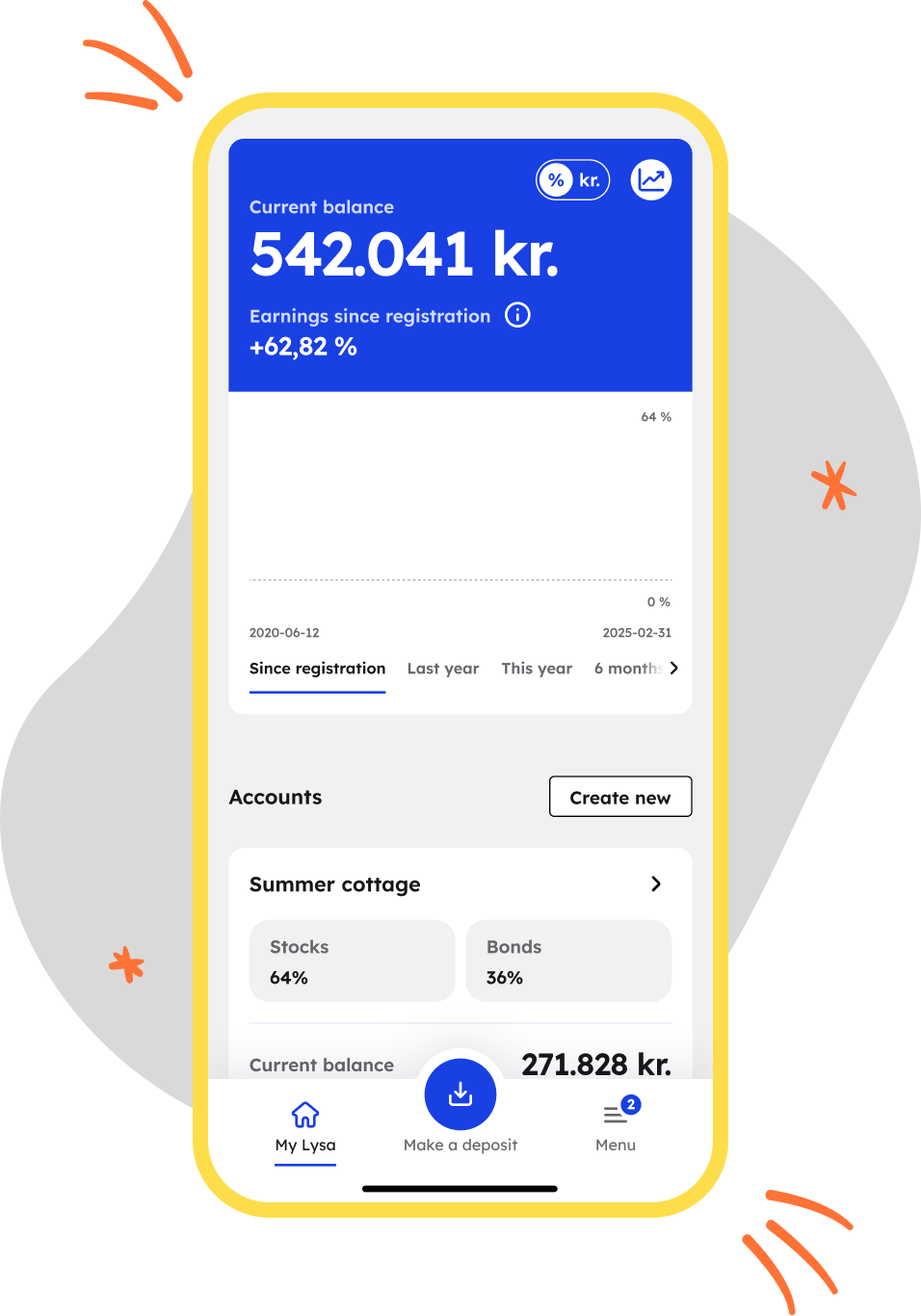

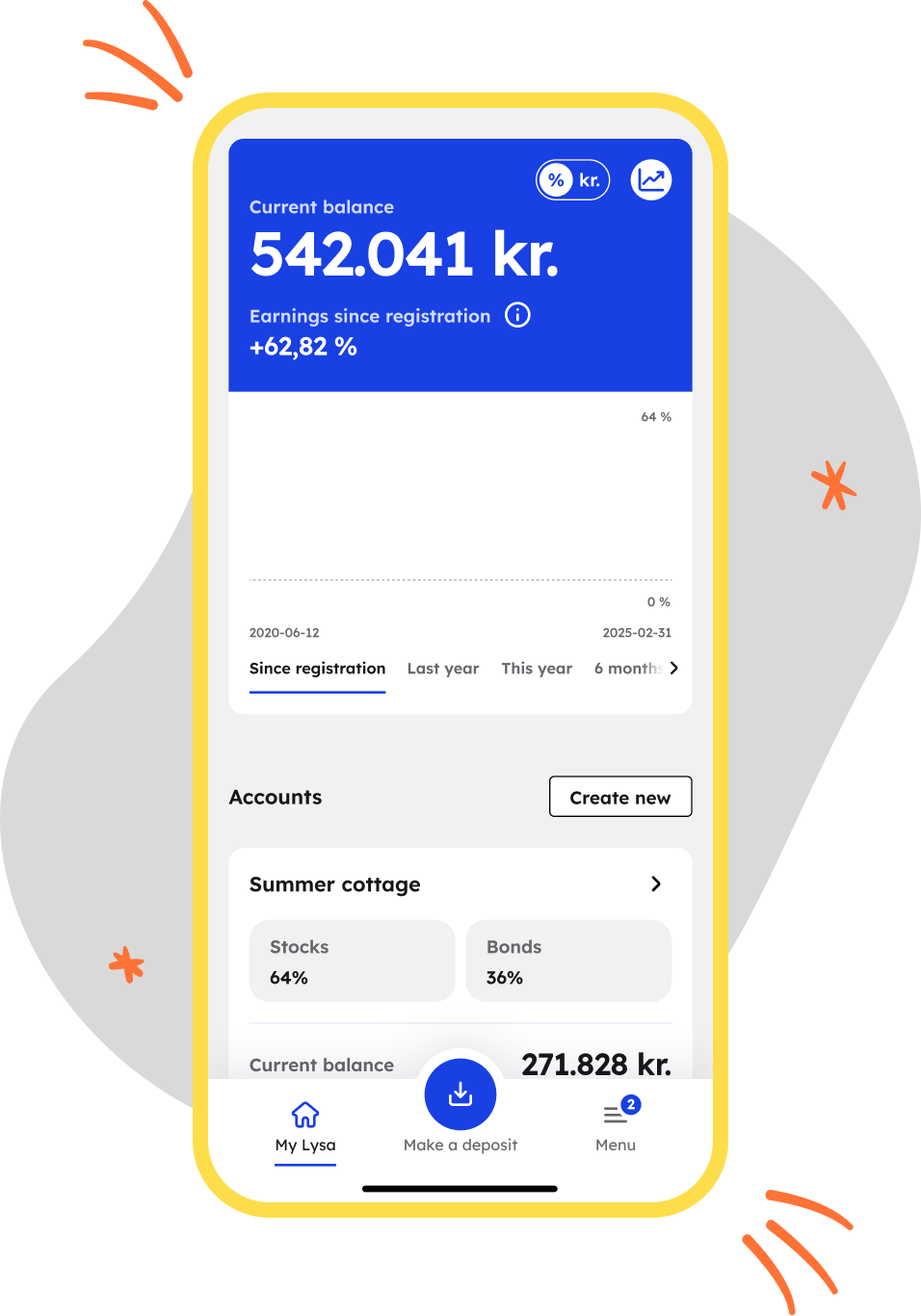

Built to suit you

We all have different dreams and goals, in life and with our investments. With Lysa, investing is not a one size fits all - it's personal. Tell us what you want to invest for and we'll provide a customised portfolio, just for you.

Zero Effort

We'll do all the work for you. Every deposit you make is invested according to your goals. And with automated rebalancing we ensure that your investments are always on track.

Ultra low fees

The math is simple - the lower fees you pay, the more money goes into your savings. Lysa invests your money into some of the world's best global index funds and ETFs, with an ultra low annual fee.

Interested in the details?

Do you want to dive deeper into the details of the research we have based Lysa upon? Feel free to read our whitepaper.

Read our whitepaperHow it works

Answer a few questions

Open an account in minutes, it's free of charge. Start by answering a few questions about you and your financial situation.

Get a customised portfolio

Based on your responses, we suggest a personalised portfolio with global index funds at a low annual fee. You can always adjust the portfolio if you want.

Relax while your money grows

Every deposit that you make gets invested automatically. And we make sure that your portfolio’s risk level stays intact over time.

Time is on your side

See how your money can grow with Lysa compared to a regular bank account.

The chart shows a simulated calculation and a hypothetical comparison. Historical returns are no guarantee for future returns. Investments can both increase and decrease in value and it is not certain that you get back the invested capital. Read more about how we calculated .

Don't just take our word for it

"Med en pris, der næsten er den halve af de danske robotrådgiveres, går svenske Lysa nu ind på det danske marked"

"En robot slår de andre klart". Best in test according to Forbrugerrådet, Tænk in 2024 and 2021.

The importance of a low fee

Over time, fees play a big part in the ultimate return. High fees that are deducted from your assets year after year eat up your capital and dampen the well-known effect of compound interest.

more in your Lysa account after 10 years compared to an equity fund with a fee of 1.56%*

Create account* The average equity fund fee in Denmark is 1.56% (March 2022). See how we calculated.

What makes Lysa better?

Based on science - not speculation

Lysa's investment strategy is based on Nobel prize winning research. Instead of stock picking, we invest your money into thousands of companies all over the world.

Customised for you

Based on your financial goals we customise each global portfolio with a risk level that suits you. So you can sleep well at night, knowing everything is on the right track.

Financial peace of mind

As time flies and markets move we automatically rebalance the portfolios so that your risk level stays intact. And with yearly updates, we make sure that your savings are in line with your life situation.

We're on your side

Low fees are key in order to gain long term results. With Lysa you pay a low annual cost without any hidden fees. Actually, part of our business model is to lower the fees for you.

No hidden fees

Lysa's only revenue comes directly from our customers. We don't accept kickbacks or payments from anyone else. This enables us to only have one interest in mind - yours.

Just as safe as your bank

With Lysa you have the same protection as you are used to with your ordinary bank. This enables you to sign up and start investing directly without having to register with any other bank.